Risk to Reward Ratio (RRR) is a fundamental concept in any form of trading, including forex trading. It’s essential for both beginners and experienced traders to find the best risk to reward ratio to make informed decisions when entering the market. This guide will break down the risk to reward ratio, its importance, and how to calculate and apply it in your forex trading strategies.

What is the Risk to Reward Ratio?

In simple terms, RRR is the ratio of the potential profit (reward) to the potential loss (risk) in a given trade. The RRR helps traders evaluate the potential outcome of a trade and make informed decisions on whether to enter or exit a position. A favorable RRR means the potential profit is higher than the potential loss, while an unfavorable RRR indicates the potential loss is greater than the potential profit. The ideal, or best risk to reward ratio, is somewhere in the middle of both extremes.

Why Use Risk to Reward Ratio in Forex Trading?

In forex trading, understanding the risk to reward ratio is essential to long-term success. The forex market is inherently volatile, and risks are inevitable. However, having a good risk to reward ratio can ensure consistent profitability even when a trader experience losses. By using the RRR effectively, traders can increase their confidence in trading decisions, reduce emotional stress, and ultimately improve their overall trading performance.

How to Identify Risk and Reward Levels

Before calculating the risk to reward ratio, traders must first identify the risk and reward levels in a trade. The risk level is the difference between the entry price and the stop-loss price, while the reward level is the difference between the entry price and the take-profit price.

Risk to Reward Ratio Formula

You can use the following formula to find the best risk to reward ratio:

In this formula, the take-profit and stop-loss orders are expressed in pips, the smallest price movement in the forex market. This allows for a standardized comparison between different currency pairs and trading strategies. A higher risk-to-reward ratio indicates a more favorable trade opportunity, while a lower ratio suggests a less attractive prospect.

How to Calculate the Risk to Reward Ratio?

To calculate the risk-to-reward ratio for a forex trade, follow these steps:

Step 1: Determine the Entry Point

The entry point is the price at which you plan to enter the trade. This can be based on technical analysis, fundamental analysis, or a combination of both.

Step 2: Set the Stop-Loss Order

The stop loss order is the price at which you would exit the trade if it moves against you, limiting your losses. This can be determined by various methods, such as a fixed number of pips, a percentage of your account balance, or a specific technical level.

Step 3: Set the Take-Profit Order

The take profit order is the price at which you would exit the trade once your profit target is reached. This can be based on predetermined profit targets, technical levels, or market conditions.

Step 4: Calculate the RRR

Using the risk to reward ratio formula mentioned earlier, calculate the best risk-to-reward ratio by dividing the difference between the take-profit and entry point by the difference between the entry point and stop-loss order. This will give you a numerical value that represents the potential profit relative to the risk involved.

Example of Calculating Risk to Reward Ratio

Let’s say you’re trading the EUR/USD currency pair, and you decide to enter a long position at 1.1000. You set a stop-loss order at 1.0950 (50 pips below the entry point) and a take-profit order at 1.1100 (100 pips above the entry point).

Using the risk to reward ratio formula:

Risk-to-Reward Ratio = (1.1100 – 1.1000) / (1.1000 – 1.0950) = 0.0100 / 0.0050 = 2.0

In this example, the risk-to-reward ratio is 2. A risk to reward ratio of 1:2, for example, means that the potential profit is twice the potential loss. This is considered a favorable RRR, as the trader can afford to lose more trades than they win and still maintain profitability. In general, a higher RRR is more desirable, as it indicates a higher potential return relative to the risk taken.

Benefits of Using Risk to Reward Ratio

Finding the best risk to reward ratio in your forex trading strategy offers several benefits:

1. Improved trade selection

By calculating the RRR before entering a trade, you can identify more favorable setups, leading to higher potential profits and better trade selection.

2. Enhanced risk management

The RRR helps you manage risk more effectively by ensuring that the potential profits justify the risks taken. This can prevent you from entering trades with a low probability of success.

3. Clearer profit targets and stop-loss levels

The RRR requires you to set specific profit targets and stop-loss levels before entering a trade. This clarity helps you stick to your trading plan and avoid emotional decision-making.

4. Increased confidence in trading decisions

Understanding and employing a favorable risk to reward ratio can lead to increased confidence in trading decisions. When traders know that their potential profits are greater than their potential losses, they are more likely to make informed and rational decisions, leading to better overall performance.

5. Better performance evaluation

The RRR can be used to assess your trading performance over time. By reviewing your historical risk-to-reward ratios, you can identify areas for improvement and make adjustments to your trading strategy.

6. Reduction of emotional stress

Trading in the forex market can be emotionally stressful, especially when experiencing losses. However, having the best risk to reward ratio can help alleviate some of this stress. By knowing that potential profits are greater than potential losses, traders can maintain a more objective perspective and avoid making impulsive, emotion-driven decisions.

Tips for Finding the Best Risk to Reward Ratio

Proper position sizing: Proper position sizing is essential for maintaining a favorable risk to reward ratio. By adjusting the size of a trade based on your risk tolerance and account balance, you can ensure that potential losses do not exceed a predetermined percentage of your trading capital. This helps you maintain a healthy RRR and achieve long-term profitability.

Utilizing stop-loss orders: Stop loss orders are crucial for managing risk and maintaining a favorable RRR. By placing a stop-loss order, you can automatically exit a position if the market moves against you by a specified amount, thus limiting potential losses and preserving your trading capital.

Setting realistic profit targets: To achieve the best risk to reward ratio, it’s important to set realistic profit targets. Overly optimistic profit targets may lead to holding onto losing positions for too long, hoping for a reversal that never comes. Realistic profit targets, on the other hand, help you maintain a healthy RRR by allowing you to lock in profits when the market moves in your favor.

Diversifying your currency pairs: Trading a diversified portfolio of currency pairs can help you achieve the best risk to reward ratio. By spreading your capital across various currency pairs, you reduce the impact of a single adverse market movement and improve your overall RRR.

What is the Best Risk to Reward Ratio?

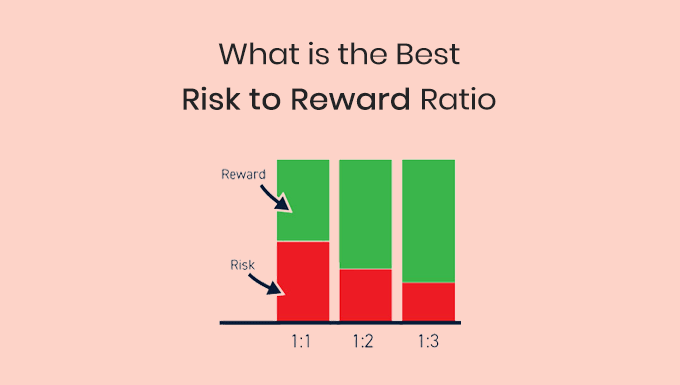

High risk to reward ratio

A high risk to reward ratio trade involves a large potential profit relative to the potential loss. For example, a trade with an RRR of 1:5 means that the potential profit is five times the potential loss. While high RRR trades can be attractive, they often come with a lower probability of success.

Low risk to reward ratio

A low risk to reward ratio trade involves a small potential profit relative to the potential loss. For example, a trade with an RRR of 1:1 means that the potential profit is equal to the potential loss. Low RRR trades may have a higher probability of success, but they require a high win rate to maintain profitability.

Best risk to reward ratio

An ideal risk to reward ratio trade strikes a balance between potential profits and potential losses, ensuring consistent profitability over time. A commonly recommended best risk to reward ratio is 1:3, which means that the potential profit is three times the potential loss. This ratio allows traders to absorb losses while still achieving long-term success in the market.

Common Mistakes to Avoid

1. Ignoring the risk to reward ratio

Ignoring the risk-to-reward ratio can lead to poor trading decisions and reduced profitability. By not considering the RRR, traders may take on excessive risks or miss out on profitable trading opportunities.

2. Overtrading

Overtrading occurs when traders enter too many positions or trade too frequently, often as a result of impatience or the desire to make quick profits. Overtrading can lead to increased transaction costs, emotional stress, and diminished trading performance. To avoid overtrading, it’s essential to maintain a disciplined trading approach and adhere to a well-defined trading plan.

3. Chasing losses

Chasing losses refers to the act of trying to recover previous losses by taking on more significant risks or entering additional trades. This behavior can lead to a downward spiral of increasing losses, as traders may make impulsive decisions driven by emotion rather than sound analysis. To avoid chasing losses, traders should stick to their trading plan, focus on maintaining a favorable risk to reward ratio, and accept that losses are an inevitable part of trading.

4. Overleveraging

Leverage is a double-edged sword in forex trading. While it can amplify potential returns, it can also magnify potential losses. Overleveraging occurs when traders use excessive leverage, increasing their exposure to the market and the risk of substantial losses. To avoid overleveraging, traders should carefully consider their risk tolerance and employ prudent leverage levels that align with their trading strategy and goals.

Conclusion

The risk to reward ratio plays a crucial role in successful forex trading. By understanding and effectively employing a best risk to reward ratio, traders can ensure consistent profitability, increase confidence in their trading decisions, and reduce emotional stress. A sound risk to reward ratio is a key component of a well-rounded trading plan, which is vital for achieving long-term success in the forex market.