One reason beginner forex traders fail is that they usually pick the wrong time frame for trading. Since most beginner traders want to get rich quickly, they are tempted to trade with small time frames like the 1-minute or 5-minute charts. But that approach is wrong. As a beginner, you might be wondering, “What is the best time frame to trade Forex?” This article will deep dive into this topic, helping you select the right time frame that suits your trading style, risk tolerance, and availability.

This article will help you to learn about the types of forex time frames; what are the differences between short-term, medium-term, and long-term time frames; the best time frame to trade forex that suits your trading style; and time frame indicators that will be useful in almost any strategy.

What Is a Time Frame in Forex Trading?

A time frame is a period of time during which a candle or bar is formed on the chart. It can be short-term (minutes or hours), medium-term (days or weeks), or long-term (months or years). So, on a 5-minute time frame, the chart consists of Japanese candlesticks, the duration of which is 5 minutes. On a 30-minute chart, it takes 30 minutes for one candle to form. For the first 5 minutes, the candles on both charts look the same, but after 10 minutes on the 5-minute chart, another candle will be added to the first candle, while the same candle will form on the 30-minute chart.

Thus, on the one-minute time frame, you can see a detailed change in price dynamics for a specific period of time, and on a higher time frame, you can see the prospect of price changes over a longer period of time.

Why Does Time Frame Matter?

The time frame is a critical aspect of trading strategy. It refers to the length of time that traders look at when analyzing market trends and making trading decisions. Different time frames offer different perspectives and can dramatically impact trading outcomes.

For beginners, choosing the right time frame can be the difference between making profits and suffering losses. So it’s essential to understand the advantages and disadvantages of each time frame.

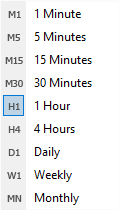

What Forex Time Frames Are There in MT4?

Short-term Time Frames

Short-term time frames involve trading on charts that are updated every few minutes (1, 5, or 15 minutes). Day traders often use these charts to make quick profits from small price fluctuations. While this might sound enticing, it requires constant attention and quick decision-making skills. It’s high-risk, high-reward territory and might not be the best fit for beginners.

Medium-term Time Frames

Medium-term time frames typically involve charts updated every hour or four hours. Swing traders often use these time frames to capture ‘swings’ in market prices over a few days. It’s less stressful than day trading and offers a good balance between risk and reward. As a beginner, this might be a great starting point to familiarize yourself with the Forex market.

Long-term Time Frames

Long-term time frames involve daily, weekly, or monthly charts. Position traders typically use these time frames for their decisions. It’s ideal for those who can’t monitor the market continuously and are comfortable with holding positions for an extended period. While it offers the least stress, it requires the most patience.

The Best Time Frame to Trade Forex for Beginners

So, what’s the best time frame to trade forex for a beginner? For most beginners, the daily time frame is an excellent place to start. It provides a comprehensive market overview, reduces the risk of overtrading, and aligns well with a busy lifestyle.

However, this isn’t a one-size-fits-all solution. The best time frame to trade Forex depends on your personal circumstances, risk tolerance, and trading goals. It’s important to experiment with different time frames, learn from your experiences, and gradually refine your trading strategy.

Choosing a Forex Time Frame for Your Trading Style

Now let’s look at how to choose a forex time frame based on your trading styles.

1. Scalping is trading on small time frames from M1 to M5 with holding positions for a very short time. This is a very dynamic and stressful trading style that requires constant attention from traders and high market volatility.

Pros:

- for scalping, a minimum deposit of $ 100 is suitable with the possibility of its rapid acceleration.

Cons:

- it takes a whole day to trade

- only currency pairs with low spreads are suitable for scalping (I recommend choosing a broker with a low spread (ECN accounts)

- the release of economic news has a strong impact on the price

- high risk of losing the deposit

2. Day trading is intraday trading, the essence of which is that all transactions are closed at the end of the day, without transferring positions to the next day. Intraday trading is carried out on time frames from M15 to H1. Unlike scalping, there is less market noise on the hourly time frame, which means it is less likely that your trade will be closed by stop loss.

Pros:

- it takes less time to trade compared to scalping

- technical analysis works well

Cons:

- it is necessary to follow the release of economic news

- sometimes false breakouts of support/resistance levels occur

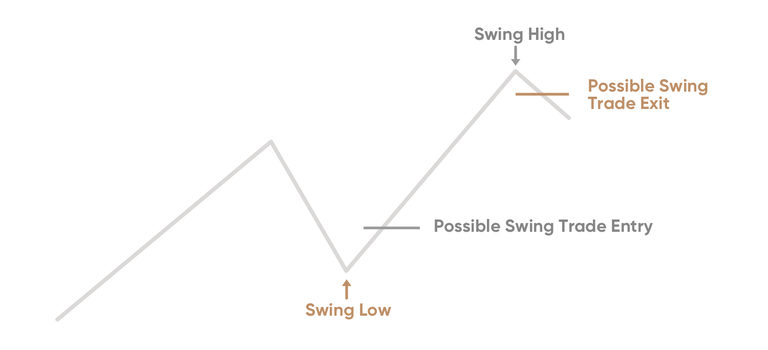

3. Swing trading is a medium-term trading that involves holding open positions for several days. Swing trading usually uses H4 and D1 time frames. It takes no more than half an hour a day to analyze daily charts, and the profit per trade can exceed several daily earnings on minute time frames.

Pros:

- a minimum of time is required for the analysis

- no need to constantly be in front of the trading terminal and monitor transactions

- technical analysis works great on the daily time frame

- since deals are opened infrequently, you can ignore the size of the spreads

- there is no need to follow the release of economic news

Cons:

- on the daily time frame, signals to enter a trade do not appear as often as during day trading

- due to large stop losses, a deposit of $ 500-1000 is required

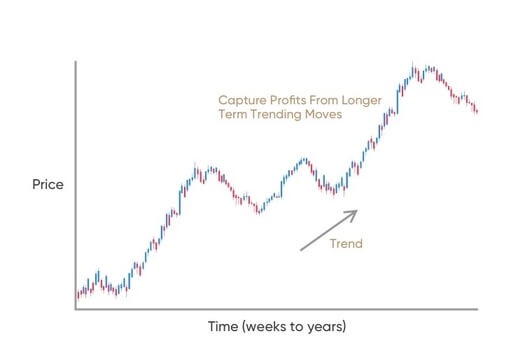

4. Position trading is a style of trading when trades are opened very rarely and held for several months. Positional trading is more suitable for patient traders (investors) who want to find the right moment to enter a trade and hold it until the global trend ends. For positional trading, you need to combine the D1, W1 and MN time frames. At the same time, fundamental analysis plays a key role in determining the trend, and technical analysis is already used to find an entry point.

Pros:

- completely free trading schedule

- no need to monitor the size of spreads and the release of economic news

Cons:

- you need to pay an additional commission for transferring positions to the next day (swap), so it is better to open a swap-free account with a broker

- a large deposit of $ 10,000 or more is required, otherwise the game is not worth the candle (what’s the point of keeping one deal for six months with a $ 100 deposit?)

Time Frame Indicators

Often, when analyzing different forex time frames, it is necessary to keep track of the higher time frame.

For example, if you trade on an hourly chart, then trades should be opened in the direction of the global trend on the daily time frame. However, it can be inconvenient to switch between charts, especially if you are constantly scalping. And if you are still trading several currency pairs at the same time, you can get confused altogether. Indicators of the higher time frame will come to your aid:

1. The MiniCharts indicator allows you to set up several small charts in one window, both lower and higher different time frames. Download MiniCharts indicator.

2. The Mcandle indicator overlays the candlesticks of the higher time frame on the chart with the lower time frame (in the indicator settings, the “TFbar” parameter must be set to a value in minutes to display the required time frame on the current chart: for H1 – 60, for H4 – 240, etc.). Download Mcandle indicator.

Conclusion

In this article, you learned about the key forex time frames, the best time frame to trade forex depending on your strategy, how to analyze time frames, and what technical indicators you can use to analyze different time frames. I hope that this article was useful to you. Happy trading!

FAQs

Q: Is there a ‘golden hour’ for Forex trading?

A: While there isn’t a universal ‘golden hour,’ the most significant market movements generally occur during the overlap of the London and New York sessions (8 AM – 12 PM EST). It’s a period of high liquidity and volatility, offering substantial profit potential.

Q: Can beginners make profits with short-term time frames?

A: While it’s possible, short-term trading (or day trading) requires significant experience, quick decision-making skills, and a deep understanding of the market. As a beginner, it might be more beneficial to start with medium to long-term time frames.

Q: How much time should I dedicate to Forex trading as a beginner?

A: This heavily depends on your availability and chosen time frame. If you’re trading on a medium-term time frame, spending a few hours analyzing the market each day could be sufficient.

Q: How can I choose the best trading strategy for different time frames?

A: Your trading strategy should align with your chosen time frame, risk tolerance, and financial goals. It’s also essential to backtest your strategy using historical data to ensure its effectiveness.

Q: Is Forex trading risky for beginners?

A: Forex trading involves significant risk due to market volatility. However, as a beginner, you can mitigate this risk by choosing a suitable time frame, using risk management strategies, and continuously educating yourself about the market.