What is Fundamental Analysis?

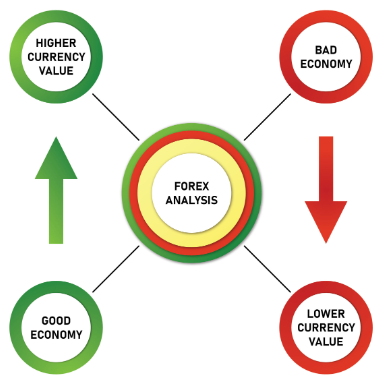

Fundamental analysis is a method used by Forex traders to evaluate the intrinsic value of a currency by examining various economic, social, and political factors. In other words, it’s a way to determine the “true” value of a currency, allowing traders to make predictions about its future performance and make informed decisions accordingly.

Components of Fundamental Analysis

Now that we’ve established what fundamental analysis is, let’s delve deeper into the key factors and indicators that form its foundation. These elements can be broadly categorized into three main groups: economic indicators, political events, and market sentiment.

Economic Indicators

Economic indicators are statistics that provide insight into a country’s economic health. These indicators can be further classified into leading and lagging indicators.

Leading Indicators

Leading indicators are data points that signal future economic changes. Some common leading indicators include:

- Gross Domestic Product (GDP): GDP is the total value of goods and services produced within a country’s borders over a specific period. A growing GDP signifies a healthy economy, which can positively impact the value of a currency.

- Interest Rates: Central banks set interest rates to control inflation and stabilize the economy. Higher interest rates attract foreign investments, increasing the demand for the country’s currency, while lower rates tend to have the opposite effect.

- Employment Data: Employment data, such as the unemployment rate and non-farm payrolls, provide valuable information about a country’s labor market. A strong labor market typically translates to a strong economy, boosting the currency’s value.

Lagging Indicators

Lagging indicators, on the other hand, confirm trends and changes after they’ve occurred. Some common lagging indicators are:

- Inflation: Inflation is the rate at which the general level of prices for goods and services is rising. Central banks monitor inflation closely, as it impacts interest rates and currency values.

- Balance of Trade: The balance of trade is the difference between a country’s imports and exports. A trade surplus (more exports than imports) can lead to currency appreciation, while a deficit (more imports than exports) can result in depreciation.

Political Events

Political events, such as elections, policy changes, and geopolitical tensions, can have a significant impact on a country’s economy and its currency value. Traders must keep a close eye on these events, as they can create short-term volatility or long-lasting trends in the Forex market.

Market Sentiment

Market sentiment refers to the overall attitude of investors towards a particular currency or the market as a whole. By understanding market sentiment, traders can gauge the general direction of a currency and make more informed trading decisions.

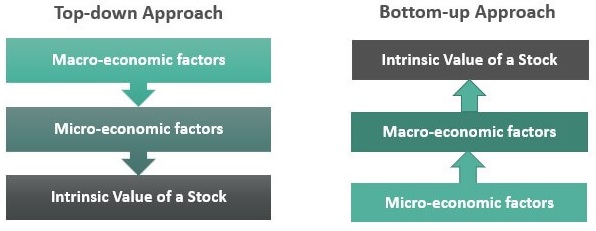

Top-Down and Bottom-Up Approaches in Fundamental Analysis

Top-Down Analysis

Top-down analysis is a macroeconomic approach that begins with a broad perspective and gradually narrows its focus. In forex trading, this involves examining global economic indicators and events before analyzing individual countries and their respective currencies. The top-down approach allows traders to identify overarching trends that can influence currency values.

Key steps in top-down analysis:

- Analyze global economic conditions: Assess the overall health of the global economy by considering factors such as GDP growth, interest rates, and inflation.

- Evaluate regional trends: Examine the economic performance of specific regions, such as the European Union or Asia-Pacific, to identify potential strengths and weaknesses.

- Assess individual countries: Delve into each country’s economic indicators, political stability, and monetary policies to gauge their currency’s prospects.

- Select currency pairs: Based on the comprehensive analysis, identify currency pairs that present potential trading opportunities.

Bottom-Up Analysis

In contrast, bottom-up analysis is a microeconomic approach that focuses on individual countries and their respective currencies from the outset. This method involves a detailed examination of each country’s economic indicators, political landscape, and central bank policies to determine the potential performance of its currency. Bottom-up analysis enables traders to make targeted decisions based on specific currency pairs.

Key steps in bottom-up analysis:

- Choose currency pairs: Select a few currency pairs that interest you or have demonstrated recent market activity.

- Analyze individual countries: Investigate each country’s economic indicators, such as GDP growth, employment data, and inflation rates, to gauge their economic health.

- Examine central bank policies: Assess how each country’s central bank policies, including interest rate decisions, might impact their currency’s value.

- Consider geopolitical factors: Evaluate the influence of political events, stability, and international relations on the currency pairs you’re analyzing.

How to Apply Fundamental Analysis in Forex Trading

Now that you have a solid understanding of the key components of fundamental analysis, let’s explore how you can apply this knowledge in your Forex trading journey.

- Stay Informed: Keep yourself updated on the latest economic indicators, political events, and market sentiment by following reputable news sources and financial websites.

- Analyze the Data: Interpret the economic indicators and political events in the context of their potential impact on currency values. Look for trends and correlations that may signal future currency movements.

- Develop a Trading Strategy: Based on your fundamental analysis, formulate a trading strategy that considers currency pairs, entry and exit points, and risk management.

- Combine with Technical Analysis: While fundamental analysis helps you understand the “why” behind currency movements, technical analysis can help you identify the “when.” By combining both approaches, you can develop a more comprehensive trading strategy.

- Adapt and Refine: The Forex market is constantly evolving, and so should your trading strategy. Continuously monitor and adjust your approach based on new data and changing market conditions.

Examples of Fundamental Analysis

Interest Rate Decisions

Central banks play a pivotal role in determining the value of a country’s currency through their monetary policies. One prime example of fundamental analysis in forex trading is the influence of interest rate decisions on currency pairs. When a central bank raises interest rates, it typically leads to an appreciation of the local currency as investors flock to take advantage of higher returns. Conversely, a rate cut can weaken the currency as investors seek opportunities elsewhere.

Example: In 2019, the US Federal Reserve cut interest rates multiple times to stimulate economic growth. As a result, the US dollar (USD) weakened against other major currencies, like the euro (EUR) and the British pound (GBP).

Economic Indicators

Economic indicators are crucial in shaping forex traders’ expectations of a country’s economic health. Key indicators include gross domestic product (GDP), inflation, and employment data. Traders use this data to predict currency trends and make informed trading decisions.

Example: In early 2020, the global COVID-19 pandemic led to a sharp decline in economic activity worldwide. The subsequent release of poor GDP figures caused many currencies to weaken, particularly those of countries heavily reliant on tourism and international trade.

Political Events and Stability

Political events and the overall stability of a country can significantly impact its currency value. Elections, referendums, and changes in government policies are prime examples of political factors that forex traders must consider when utilizing fundamental analysis.

Example: The Brexit referendum in 2016, in which the UK voted to leave the European Union, caused significant fluctuations in the value of the GBP. The uncertainty surrounding the UK’s future relationship with the EU led to heightened volatility in forex markets, with many traders closely monitoring political developments to inform their trading strategies.

Natural Disasters and Geopolitical Events

Unforeseen events like natural disasters, terrorist attacks, and military conflicts can also have a profound impact on currency values. Forex traders must remain vigilant and adapt their strategies in response to such events.

Example: The devastating earthquake and tsunami that hit Japan in 2011 severely impacted the country’s economy and caused the Japanese yen (JPY) to fluctuate. Traders who were quick to assess the situation and incorporate this information into their fundamental analysis could capitalize on the currency’s movements.

Advantages of Fundamental Analysis

Informed Decision-Making Based on Financial Data

Fundamental analysis allows traders and investors to gather relevant information to make rational choices about their positions. By relying on financial data, personal biases are significantly reduced, leading to more objective decisions.

Focus on Long-term Value and Market Corrections

Instead of solely determining entry and exit points, fundamental analysis aims to comprehend an asset’s true value to facilitate a long-term perspective of the market. After assigning a numerical value to the asset, traders can compare it to the current market price to determine if it is over- or under-valued. The goal is to capitalize on eventual market corrections.

Disadvantages of Fundamental Analysis

Time-Consuming and Complex Process

One major drawback of fundamental analysis is its time-consuming nature. The process necessitates examining multiple aspects of an asset, making the overall analysis quite intricate.

Incompatibility with Short-Term Trading Strategies

Fundamental analysis focuses on long-term market views, rendering its results unsuitable for immediate decision-making. Traders interested in developing strategies for short-term entry and exit points might find technical analysis more appropriate.

Unpredictable Economic, Political, or Legislative Changes

Despite offering a comprehensive market outlook, fundamental analysis cannot always account for unforeseen negative economic, political, or legislative changes. Such surprises can impact markets and result in unexpected outcomes.

Conclusion

Fundamental analysis is an invaluable tool for Forex traders, providing insights into the underlying factors that drive currency values. By understanding and interpreting economic indicators, political events, and market sentiment, you can make more informed trading decisions and increase your chances of success in the Forex market.

FAQs

Q: What is the primary goal of fundamental analysis in Forex trading?

A: The primary goal of fundamental analysis is to determine the intrinsic value of a currency by examining various economic, social, and political factors, allowing traders to make informed trading decisions.

Q: What is the difference between leading and lagging economic indicators?

A: Leading indicators signal future economic changes, while lagging indicators confirm trends and changes after they’ve occurred.

Q: Why is market sentiment important in fundamental analysis?

A: Market sentiment provides insights into the overall attitude of investors towards a particular currency or the market as a whole, helping traders gauge the general direction of a currency.

Q: Can fundamental analysis be used in conjunction with technical analysis?

A: Yes, combining fundamental analysis with technical analysis can help traders develop a more comprehensive trading strategy, as fundamental analysis explains the “why” behind currency movements, and technical analysis identifies the “when.”

Q: How can I stay updated on the latest fundamental analysis data?

A: To stay informed on the latest fundamental analysis data, follow reputable news sources, financial websites, and consider subscribing to economic data release calendars.