Why learn forex trading and how does it work? This has become an increasingly popular topic in recent years as more people look for alternative ways to make some extra money.

However, it takes a lot of practice, dedication, and discipline to get to the point where you can make consistent profits from it.

In fact, most beginners who start trading forex fail very quickly without proper trading knowledge and guidelines.

But if you learn it right, forex trading can be extremely profitable and rewarding.

Forex market is the largest financial market globally, and it attracts many newcomers every day due to its ability to make passive income quickly.

You don’t need any qualifications or certificates of expertise to start trading forex. A laptop, Internet access, and a little start-up capital are all that you need to get started. This is why forex trading has become very popular today among millions of traders around the world.

If you have decided to start trading or still considering whether to become a professional Forex trader, this step-by-step guide will cover everything you need to know about why learn forex trading.

Table of Contents

• What is Forex Market?

• Forex Market Hours

• Why Learn Forex Trading?

• Who Trades Forex?

• Forex Trading Terminology

• What Currencies Traded?

• How to Make a Forex Trade

• How to Manage Risk?

• Money Management Techniques

• Forex Market Analysis

• Forex Trading Strategies

• Trading with a Demo Account

• How to Find the Right Forex Broker

• 20 Forex Trading Tips for Beginners

• Conclusion

What is Forex?

Forex (in simple terms, currency) is also called foreign exchange, FX, or currency trading. It is the largest financial market in the world, with a daily turnover of more than US$5 trillion a day, larger than all US equity and Treasury markets combined.

What is Forex Market?

Forex is a global and decentralized market where currencies are traded.

Unlike other financial markets that operate at a centralized location (i.e., stock exchange), the worldwide Forex market has no central location. It is a global electronic network of banks, financial institutions, and individual traders, all involved in buying and selling national currencies.

Each of these currencies has a conversion rate, which is called an exchange rate. For example, if the exchange rate of EUR/USD is 1.10, it means that 1 Euro is equal to 1.10 US Dollars.

What Are the Forex Market Hours?

The forex market is open 24 hours a day and 5 days a week. However, it does not mean it is always active. Let us check what a 24-hour day in the forex world looks like.

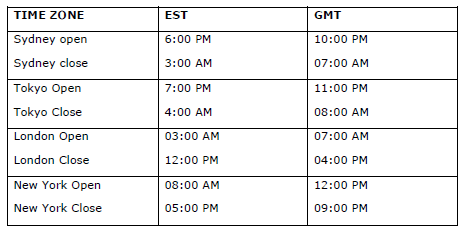

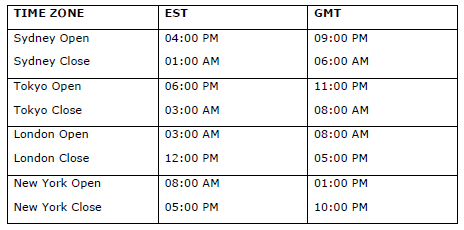

The forex market is divided into four major trading sessions: the Sydney session, the Tokyo session, the London session, and the New York session.

The following tables show the opening and closing times of each session.

Summer Session (Around April – October)

Winter (Around October – April)

Note: The actual opening and closing timing of the forex market depends on local business hours.

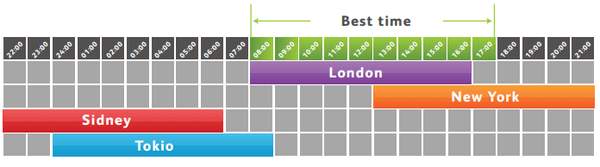

We can see in the above chart that in between different forex trading sessions (region wise), there is a period of time where two sessions (region time) are open at the same time.

There is always more trade volume when two markets (in different regions) are open at the same time.

Why Learn Forex Trading?

So, why learn forex trading? There are many reasons to learn and trade forex.

If we ask four different people, you might get more than four different answers. Primarily, making money is the most frequently cited reason for why trade Forex.

Reasons Why People Trade Forex

24-hours open market

You do not have to wait for the opening bell to ring to start trading in forex as the Forex market works 24 hours and 5 days a week.

The forex market starts from the Monday morning opening of the Sydney session to the afternoon close session of the New York session. This allows us to trade anytime we prefer without giving much attention to what time it is.

Low transaction cost

Most forex accounts trade with little or no commission, and there are no exchange or data license fees.

Generally, the retail transaction fee (the bid/ask spread) is typically less than 0.1% under normal market conditions. With larger dealers (where volumes are huge), the spread could be as low as 0.05%.

Leverage

Leverage is the mechanism by which a trader can take a position much larger than the initial investment and thus can make significant profits from the small movement in the market.

It is one of the factors, which drags more and more traders towards forex trading. Few currency traders realize the advantage of financial leverage available to them.

Little investment

The potential traders can open mini accounts even for a few bucks of dollars. Forex trading has high leverage, which is around 500:1. It only signifies that your assets can be controlled 100 times over your invested money.

High liquidity

The forex market can handle transactions even if it reaches 1.5 trillion dollars every day.

Take note, and this is a huge volume. It only denotes that sellers and buyers are always available regardless of the currency types.

So, if the trader wanted to buy, there is always an available seller, and if the trader wanted to sell, there is always an available buyer.

Accessibility

Getting started as a currency trader would not cost a ton of money, especially when compared to trading stocks, options, or futures markets.

There are online forex brokers who offer “mini” or “micro” trading accounts that let you open a trading account with a minimum account deposit of $25. This allows an average individual with very less trading capital to open a forex trading account.

Who Trades Forex?

The forex market is massive in size, and due to the low entry barriers, it has millions of participants around the world.

The main forex market participants in this market are:

– Central Banks

– Major commercial banks

– Investment banks

– Corporations for international business transactions

– Hedge funds

– Speculators

– Pension and mutual funds

– Insurance companies

– Forex brokers

Forex Trading Terminology

Let us now look at some of the most commonly used terms you’ll encounter in trading that you’ll need to know.

Spot forex

Spot forex involves buying and selling of real currency. For example, you can buy a certain amount of pounds sterling for euros, and then, once the value of the pound increases, you can then exchange your euros again for the pounds you originally bought. Can get back more money than what was spent on the purchase.

Contract for Differences (CFD)

You will sometimes hear about CFD trading while learning forex.

There are two ways to trade forex: CFDs and spot forex.

The term CFD is short for ‘Contract for Difference’ – and is a contract used to represent movement in the prices of financial instruments.

In forex trading, this means that instead of buying and selling large amounts of currency, you can profit on price movements without owning the asset.

Along with forex, CFDs are also available on stocks, indices, bonds, commodities, and cryptocurrencies. In every case, they allow you to trade on the price movements of these instruments without buying them.

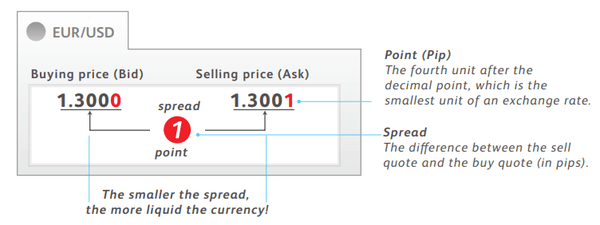

Pip

A pip is effectively the smallest change a forex price can make.

Any currency pair has a base unit of price in the currency pair or 0.0001 of the quoted price. Therefore, when the bid price for the EUR/USD pair moves from 1.16667 to 1.16677, that represents a difference of 1 pip.

Spread

The spread is the difference between the bid and ask price of a currency pair.

For example, if the bid price for EUR/USD is 1.16668, and the selling price is 1.16669, the spread would be 0.0002 or 2 pips.

In any forex trade, the value of a currency pair will need to exceed the spread before it can become profitable.

Lot size

A lot is a unit to measure the amount of the deal. The value of your trade always corresponds to an integer number of lots (lot size * number of lots).

Trading with the proper position or lot size on each trade is key to successful forex trading. The position size refers to how many lots (micro, mini or standard) you take on a particular trade.

Leverage

This concept is a must for a beginner who wants to learn what is forex trading.

Leverage is the capital provided by a forex broker that can increase the volume of trades of its clients.

For example, the current exchange rate for the EUR/USD pair is 1.1150, and we want to open a 1 lot position (100,000 units).

If our leverage is 1:500, then the margin required for such orders will be $100,000 / 500 = $200.

When leverages are working in our favor, it is really good for us and produces higher profits, but when it opposes our interests, it can cause huge losses. Therefore, you should be cautious before using leverage in forex trading.

Margin

Margin is the amount of money your trading account (or broker needs) should have as a “good faith deposit” to open any position with your broker.

So consider the leverage example in which we can take a position of $100,000 with an initial deposit amount of $1000. This $1000 deposit amount is called the “margin” you had to give, to initiate a trade and use leverage.

For example, if your broker required a 5% margin, you have a leverage of 20:1, and if your margin is 0.25%, you can have a leverage of 400:1.

Bear market

The bear (bearish) market is the one where the market is going down.

In other words, when the price of a currency is falling. If a price falls deep and fast, it’s considered very bearish.

A bear market denotes a negative trend in the market as the investor sells riskier assets such as stock and less-liquid currencies such as those from emerging markets. The chances of loss are far greater because prices are continually losing value. Investors or traders are better off short-selling or moving to safer investments like gold or fixed-income securities.

Bull market

A bull (bullish) market is used to describe conditions where the market is rising.

In a bull market, the confidence of the investor or the traders is high. There is optimism and positive expectations that good results will continue. So in all, a bull market occurs when the economy is performing well – unemployment is low, GDP is high, and the market is rising.

Long trade

Whenever you purchase (buy) a currency pair, it is called going long. When a currency pair is long, the first currency is purchased (indicating you are bullish) while the second is sold short (indicating you are bearish).

For example, if you are purchasing a EUR/USD currency pair, you expect that the price of Euro will go high and the price of Indian rupees (USD) will go down.

Short trade

Go short on a currency means you sell it hoping that its prices will decline in the future. When you go short on forex, the first currency is sold while the second currency is bought.

Pending orders

A pending order is an order that was not yet executed, thus not yet becoming a trade.

Generally, while trading, we place the order with a limit, which means our order (pending trade) will not get executed if the price of a financial instrument does not reach a certain point.

The most commonly used pending orders are Buy Limit, Sell Limit, Buy Stop, and Sell Stop.

Broker

Forex brokers are there to assist you with your trading needs in exchange for a small commission from what you earn.

What Are Currencies Traded in Forex?

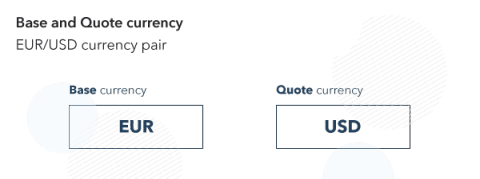

Currencies are always traded in pairs. The pairs have a unique notation that expresses what currencies are being traded.

The currency left of the pair is called the base currency.

The currency right of the pair is called the quote or counter currency.

When you place an order to buy the EUR/USD, you are actually buying the EUR and selling the USD.

If you were to sell the pair, you would be selling the EUR and buying the USD. So if you buy or sell a currency PAIR, you are buying/selling the base currency.

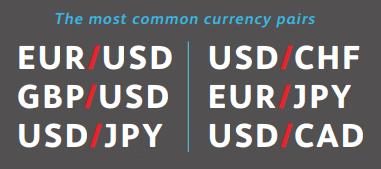

Forex pairs are divided into Major (Major), Minor (Minor), and Exotic (Unique).

Major currency pairs are made up of the most commonly traded currencies, which are:

- USD – US Dollar

- EUR – Euro

- JPY – Japanese Yen

- GBP – British Pound

- CHF – Swiss Franc

- CAD – Canadian Dollar

- AUD – Australian Dollar

- NZD – New Zealand Dollar

A major currency pair is one that includes the US dollar, such as EUR/USD, USD/JPY, or GBP/USD.

– EUR/USD Euro against US Dollar

– USD/JPY US Dollar against Japanese Yen

– GBP/USD British Pound against US Dollar

Forex minor (minor) pairs are made up of these major currencies that do not include the US dollar. These pairs include EUR/GBP, EUR/CHF, AUD/NZD, etc.

Finally, exotic currencies are currencies we haven’t mentioned before, such as the Hong Kong dollar (HKD), Norwegian krone (NOK), South African rand (ZAR), and Thai baht (THB). Unique pairs include one forex and one major currency.

When learning what forex trading is and how it works, beginners should not trade with all the available currency pairs. Major currency pairs are the best currency pairs to trade for beginners due to daily volatility and tight spreads.

How to Make a Forex Trade?

Now let’s talk about things to consider before making a trade.

Before you make a trade, you’ll need to decide which kind of trade to make (short or long), how much it will cost you and how big the spread is (difference between ask and bid price).

Knowing these factors will help you decide which trade to enter.

When trading forex, you will notice that the ‘bid’ and ‘ask’ prices are quoted.

Bid: The bid price is the price at which you can buy any currency

Ask: The ask price is the price at which you can sell any currency.

If you are buying a currency in a trade, this is known as a long trade, and expect the currency pair to rise in value, allowing you to sell it at a higher price and make a profit on the difference.

If you are selling a currency in a trade, the opposite is true – the expectation is that the currency pair will decline in value, causing you to repurchase it at a lower price, meaning you will make a profit on the difference. Such trading is called short trading.

The numbers quoted for these prices are based on the current exchange rate of the currencies in the pair, or how much of the second currency you will get for one unit of the first currency.

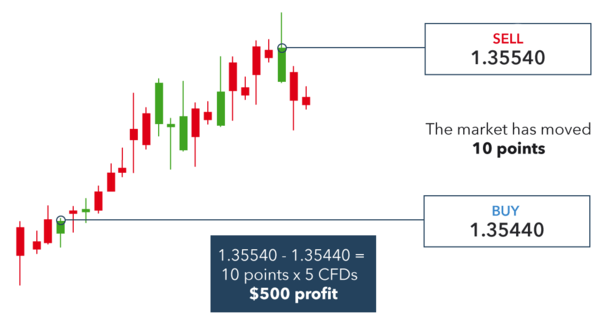

For example, high-impact news about US non-farm payroll just released against the US dollar and we can safely predict that the US dollar should drop soon.

1 lot buying position is being opened with EUR/USD exchange rate, with a leverage ratio of 1:500 and an exchange rate of 1.35440.

A few hours later, the open position is being closed at 1.35540. The price has moved 10 points up. (1.35440 – 1.35540).

With 10 points x 1 lot x 500 (leverage), we’ve made a $500 profit from this transaction.

If traders profit from the difference between the bid and the ask price, their next logical question is, how much can be expected to move in any given currency?

It depends on how liquid the currency is or how much of it is being bought and sold at any one time.

The most liquid currency pairs in the forex market are those with the most supply and demand. This supply and demand are generated by banks, businesses, importers and exporters, and traders.

Major currency pairs are the most liquid, with the EUR/USD currency pair moving by 90-120 pips on an average day.

How to Manage Risk in Forex Trading?

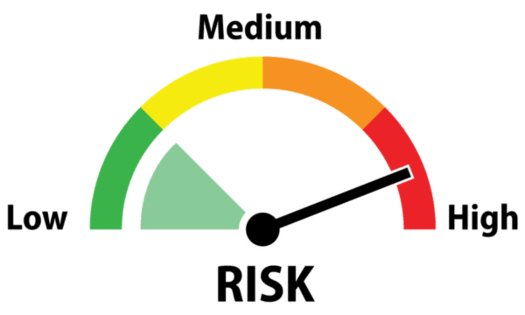

Forex trading risk management is one of the most important aspects of trading for a beginner who wants to learn forex trading.

To become profitable, you want to keep any potential losses as small as possible, but, on the other hand, you would want to squeeze as much potential profit out of each trade.

Below is a list of best practices that you should follow to manage the trading risk.

1. Diversify your portfolio

We all know the saying “don’t depend on only one instrument.” Yet, many new forex traders do this with their investments. Not having all your money in one trade and not relying on a single currency pair increases your risk level.

You can also consider other CFD instruments like stocks, indices, commodities, cryptocurrencies, etc., as these will diversify your trading portfolio.

2. Use leverage wisely

As I have already mentioned, forex CFDs allow you to trade on margin or using leverage. But that doesn’t mean you need to use it.

For example, after assessing your risk, you may decide that the potential cost of trading with a leverage of 1:30 level is too high, and you are more than happy to work with 1:5. You can do the same.

3. Focus on long term

The initial phase of your business should conserve your capital and not try to grow it. Risk reduction is the primary objective. Possibly one way to achieve this is to use a long-term trading stance.

4. Use stop loss

A stop loss is a tool that traders use to limit their potential losses. Simply put, it is the price level at which you would close a trade that is not going in your favor. There will be no further losses as the market moves in the opposite direction of what you expected.

5. Keep learning

The markets change constantly, and new forex indicators, trading ideas, and strategies are being published daily. To continuously develop your trading skills, read market analysis regularly, and learn new trading strategies.

6. Build a trading discipline

The truth is that building a trading discipline is one of the critical success factors in separating successful traders from unsuccessful traders.

Developing trading discipline and the ability to manage your emotions is important in keeping yourself calm in times of stress and entering trades at the right times.

You also need to know when to exit trades, whether you are cutting your losses or taking your profits before entering the market.

Money Management Techniques in Forex Trading

Money management refers to how you manage your trading capital.

It has to do with how much money you invest in each trade. Also, how much do you expect to make on each trade compared to how much you are risking?

Money management is an essential part of forex trading which every trader should know. Especially as a beginner when you are learning what forex trading is and how it works. There are a lot of mistakes that forex traders make, and not following their own money management system is one of them.

Let’s look at some of the basics of money management

Decide in advance what money to use for trading

Only one type of money is good for investing – the ones you are willing to lose. Invest without harm to your physical and/or mental health. Every successful trader is profitable in his own way. Remember, use every available opportunity to learn. It’s a never ending process!

Define your level of investment

One of the most common questions about forex trading is ‘How much money do I need to start trading?’ For beginner traders, it is a good idea to start small and work your way up. Fortunately, many forex brokers have reasonable minimum deposit levels to open an account.

Determine the profits required to recover any losses

Before entering any trade, calculate how much you will need to spend to regain those funds in any future trade. It is often difficult to make money, and just because your remaining investment fund is small, you will make a large profit (percentage-wise) to make up for your losses.

For example, if you invested 5,000 EUR and lost 2,000 EUR, you would lose 20% of your balance, giving you a final balance of 4,000 EUR. To bring your balance to EUR 5,000, you would need to make a profit of EUR 1,000. However, with an opening balance of 4,000 EUR (after the previous loss), there is now a 25% profit instead of a 20% one.

Start with small trades

To help manage your risk and preserve your capital, trade small amounts rather than taking large risks with a large fund. For example, in the previous example, if you put your entire 2,000 EUR on a single trade, you would have easily lost it all.

Conversely, if you have just traded 20 EUR, your account balance will not lose much. This will allow you to learn from your experience and plan your next trade more effectively. With this in mind, limiting the capital, you prepare to risk 5% (or less) of your account balance will give you the opportunity to forex trading (and improving your technique) over the long term.

Types of Forex Market Analysis

While some new forex traders may ride their luck and profit from the right direction of the currency pair, this luck does not always last. For long-term trading success, a trader should make logical trading decisions based on proper market analysis.

The analysis is very important for trading. There are three types of analysis used for the market movements forecasting:

- Fundamental Analysis

- Technical Analysis

- Sentiment Analysis

These three strategies go hand-in-hand to help you come up with good forex trade ideas. All the historical price action (for technical analysis) and economic figures (for fundamental analysis) are there – all you have to do is put on your thinking cap (for sentimental analysis) and put those analytical skills to the test.

What is Fundamental Analysis in Forex?

Fundamental analysis is the analysis of social, economic, and political factors that affect currency supply and demand with the hope of predicting future currency price movements.

For example, the Australian dollar value may fluctuate after the Reserve Bank of Australia’s interest rate announcement, which will then affect the movements of all currency pairs, including the AUD.

The economic indicators that have the greatest impact on the forex market are:

– Interest rates of national banks (e.g., European Central Bank or US Federal Reserve)

– Gross Domestic Product Growth (GDP)

– Number of jobs outside the agriculture sector (known as non-farm pay)

– Unemployment rate

– Consumer Price Index (CPI)

– Retail Sales

– Industrial Production

What is Technical Analysis in Forex?

While fundamental analysis focuses on what is happening in the real world, including economic, political, and business news and events, technical analysis largely focuses on what is happening in trading charts.

Technical analysis helps predict future market movements (that is, changes in currency prices, volumes, and open interests) based on the information obtained from the past.

Basically, it is the study of price, learning how to read Japanese candlestick charts and, and volume movement.

There are different kinds of charts that help as tools for technical analysis. These charts represent the price movements of currencies over a certain period of time, as well as technical indicators. The technical indicators are obtained through mathematical processing of averaged and other characteristics of price movements.

What is Sentimental Analysis in Forex?

The participants in every market, the traders, and the investors have their own opinion of why the market is acting the way it does and whether to trade in the market’s direction (towards market trends) or go against it.

The trader’s view on how he is feeling about the market, whether bullish or bearish. Depending on this, a trader further decides how to play the perception of market sentiment into a trading strategy.

Types of Forex Trading Strategies

Forex trading is all about trading based on a strategy. Forex trading strategies help you gain an insight into the market movements and make moves accordingly.

For beginner traders, developing and sticking to a simple and effective strategy is crucial.

Here are the 6 most popular forex trading strategies you can follow

1. Scalping – Scalping is a trading strategy that involves buying and selling currency pairs over a very short period of time – usually between a few seconds and a few hours. This is a very work strategy that involves making a large number of small profits until those profits add up.

2. Intraday trading – Intraday trading is a more conservative approach than scalping, focusing on daily price trends in trades. Such trades are used for between one and four days but usually focus on the key sessions for each forex market.

3. Swing trading – Swing trading is a medium term trading approach that focuses on larger price movements than scalping or intraday trading. This means that traders can set up a trade and check on it within a few hours or a few days. Instead of constantly sitting in front of their trading platform, this is a great option for people looking to work a day and trade.

4. Forex hedging – Hedging is a risk management technique where a trader can cover potential losses by taking opposite positions in the market. In forex, this can be done by taking two opposite positions on the same currency pair (such as by opening a long trade and a short trade on the GBP/USD currency pair) or by taking opposite positions on two correlated currencies.

5. Martingale strategy – Martingale Strategy is a trading strategy whereby for every losing trade, you double the investment you make in future trades to recover your losses as soon as you make a successful trade. For example, if you invest 1 EUR on your first trade and lose, on the next trade, you can invest 2 EUR, then 4 EUR, then 8 EUR. Please note that this strategy is risky in nature and not suitable for beginners!

6. Grid strategy – The grid strategy uses buy stop orders and sell stop orders to profit on natural market movements. These orders are usually placed at 10 pip intervals and, by placing these stop orders, a trader can automate this trading strategy.

Trading with a Demo Account

After selecting a suitable forex strategy, the next step is to test the strategy to see how it works.

The best way to do this is to try it using a Demo account. Today, most forex brokers offer Demo accounts with a range of leverage options.

The purpose of using a demo account is to get you comfortable making trades and to help you become familiar with the broker’s trading platform.

This allows you to trade the markets in real-time using virtual money without the need to risk any of your real money. Demo accounts are therefore good for a beginner trader who is in the process of learning forex trading.

Once you are comfortable trading with your demo account and feel confident after practicing, you can open a live account.

How to Find the Right Forex Broker?

It is no secret for any trader that choosing a good forex broker is very important for successful trading. A broker provides traders with access to trading on the foreign exchange market through a special trading terminal.

There are many forex brokers available in the market today that promise their clients only the best trading conditions and guarantee the safety of all trading transactions.

But do not believe all such promises since many brokers engage in outright fraud and try to lure money from traders and then disappear.

10 Key Factors to Consider When Selecting a Good Forex Broker

1. Is the broker regulated? – It is important to ensure that the Forex broker has a license to carry out financial activities. Therefore, choose a broker regulated by agencies such as the Commodity Futures Trading Commission (CFTC) or Financial Conduct Authority (FCA) and ensure that they are allowed to operate in your country.

2. Broker’s reputation – Do a background check of forex brokers and check their ratings, which are regularly updated by various companies based on the reviews of other traders. Ratings allow you to see the general picture of the market. In any case, attention should be paid to market leaders who have earned a decent reputation and can offer really favorable conditions for cooperation.

3. Account types – Brokers do offer many account types. You should review these to ensure they have an ideal account type for you. They can have raw spreads from 0 pips, mini, standard, or premium accounts that require a different amount of capital.

4. Spreads – Brokers do not make a commission on your trade. Instead, they take the spread as compensation. Pick a broker who has a lower spread.

5. Slippage – Can they provide you with details of just what slippage they would expect to occur during normal and volatile markets?

6. Leverage – Leverage will vary from one broker to another. For traders who utilize a high degree of leverage as part of their trading strategy, a broker’s leverage policy review is a must.

7. Minimum deposit – Choose a broker who has a minimum deposit that fits inside your budget. Typically this can be around $200.

8. Trading platforms – Brokers should offer the most up-to-date and user-friendly platform where you can easily view the charts, execute your analysis, compare currencies, use different indicators, and place orders.

9. Deposit and withdrawal – You will want to deposit and withdraw from time to time. Therefore check out what funding methods they allow, transaction fees, how long it takes to process, etc.

10. Rollover policy – Do they have any minimum margin requirements which they use to earn interest on any overnight positions? Plus, do they have any other requirements or conditions about you earning interest on any rollovers.

Remember to read the trading instructions carefully to know how the broker can help you manage your trades. If you overlook some relevant details, you can lose money on your first trade. So take the time to read the details and ask the brokers or their support staff any questions you may have before you open your first trade.

20 Forex Trading Tips for Beginners

To help you get started trading forex with confidence, I’ve put together a few ideas, tips, and best practices to help you build a more comprehensive trading plan.

1. Trade small amounts when you are a beginner. Grow your account balance through profits, not deposits.

2. Traders often fail because they don’t learn from mistakes. Keep a diary of trades to discover what works and what doesn’t.

3. Performing a multiple time frame analysis helps to identify the market direction. Weekly graphs are used to observe trends, daily and hourly graphs – to observe the best time to open and close positions.

4. There isn’t a single perfect trading strategy. The most important thing is to pick one that suits your personality.

5. Don’t chase a losing position out of emotion. Stick to your trading plan, and don’t throw good money after bad.

6. If you find yourself getting tired, angry, or frustrated when trading, take a break to get yourself back under control.

7. Some currency pairs are volatile, and others are relatively stable. Choose the pairs that best suit your risk profile.

8. Set stop/loss and limit orders to reflect your risk tolerance. The further apart they are, the more risk there is.

9. Educating yourself and creating a trading plan is good, but master to stick to that plan through patience and discipline.

10. Before starting live trading, put your trading plan to the test in real market conditions with a demo account.

11. Pay attention to economic calendars. Surprises in GDP and other data can move the market quickly.

12. When starting, study a single currency pair. Don’t spread yourself too thin by trading multiple pairs.

13. Don’t let emotion get in the way of your plan for successful trading. “Revenge trading” rarely ends well.

14. Choose a reputable forex broker that offers you trading conditions and currency pairs that match your trading strategy.

15. Don’t get overconfident when you have a big win. Stick to your trading strategy and don’t take reckless risks.

16. Pay attention to the spread between the bid and ask. This can change and make the difference between profit and loss.

17. Study horizontal support and resistance levels. Look for price action at these to find high-probability opportunities.

18. The timeframe you choose to trade determines how long to hold a trade. For example, if you use an hourly chart, you must hold for at least an hour.

19. Don’t dwell on the past. Forget about your losses and missed opportunities, and look forward to your next trade.

20. Always use stop-loss orders whenever you enter a trade to limit their risk and avoid a potentially catastrophic loss.

Conclusion

In this article, I’ve covered a lot of ground about why learn forex trading and how does it work. I hope it will provide some insight and guidance to beginner forex traders. Learning how to trade forex isn’t that difficult. All it takes is quality education, practice, dedication, and discipline.

Nice! Sharing information is very nice.